Nowadays, there is an app for everything. But wouldn’t it be nice if you could manage all your finance stuff from one app without having to navigate between multiple sources? Thanks to Revolut USA, now you can!

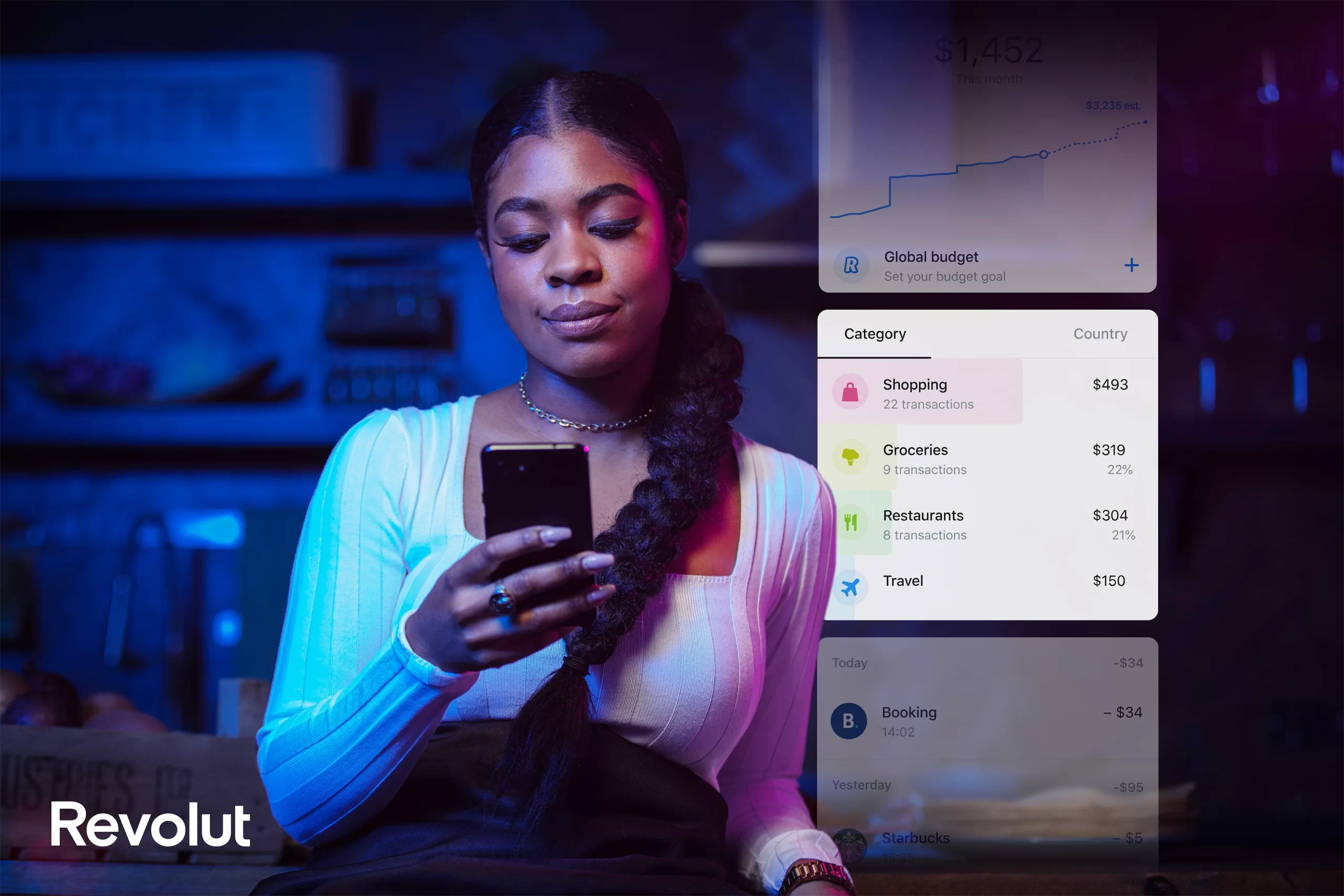

Revolut is much more than a travel card or money transfer service. The innovative Revolut app lets you manage your salary, transactions, budget, savings, and more, all on the same app.

Moreover, Revolut USA is available to all US citizens, and there are no prerequisites for opening an account or ordering a card.

So, if you’re fed up with traditional banks and looking for a smarter, easier, and future-ready way to manage your money, read on to find out everything you need to know about Revolut USA.

What Is Revolut?

Revolut is a British company founded in 2015. However, Revolut US launched in 2020, allowing Americans to manage all aspects of their finances digitally.

Revolut began as a cheaper and easier way to send and request money worldwide (both to other Revolut users and to bank accounts). Their unique selling point is that you always get the real exchange rate with no hidden fees.

However, over the years, Revolut has expanded significantly, becoming everyone’s favorite go-to app for money management.

Along with sending and receiving money, you can now use the app’s budgeting tools, unlimited disposable virtual cards for safer online shopping, and much more.

Revolut USA offers three plan options:

| Information | Standard | Premium | Metal |

| Price | No fee | $9.99/month | $16.99/month |

| 100% no-fee ATM withdrawals at over 55,000 ATMs | Yes | Yes | Yes |

| No fee card delivery | Yes | Express | Express |

| Card Personalisation | Yes | Yes | Yes |

| No fee for international transfers per month | 1 | 3 | 5 |

| No fee currency exchange | $1,000/m limit | $10,000/m limit | Unlimited |

| 24/7 priority customer support | No | Yes | Yes |

| Exclusive metal card | No | No | Yes |

| Purchase protection (Theft and accident coverage for up to 90 days) | No | Yes | Yes |

| Returns protection (Get refunded up to 90 days after purchase) | No | Yes | Yes |

What Does Revolut USA Offer?

As we just mentioned, Revolut US offers various features. So if you don’t typically send or receive money from overseas, this doesn’t mean a Revolut account won’t benefit you.

Here are some of the top things that Revolut offers US customers:

- Send and receive money overseas to other Revolut customers and bank accounts – Transfers to and from Revolut customers worldwide are instant and without fees.

- Fair, transparent rates with no hidden fees.

- Hold and exchange 28 currencies in the app, including GBP, CAD, and Euro.

- Make online international purchases at the real exchange rate.

- Receive your salary up to two days in advance via direct deposit for no additional cost.

- Budgeting tools to track your spending and set monthly budgets (for your total expenditure or individual categories). You can receive notifications when you are approaching your budget.

- A virtual spare change jar by choosing to round up every card payment to the nearest dollar and adding the spare change to your savings account.

- Instant transaction notifications showing the amount spent and where. So, if someone accesses your account and manages to make a purchase, you’ll find out straight away.

- Personalized security features – Through the app, you can change settings regarding swipe payments, contactless payments, and ATM withdrawals, turning them on/off and adjusting limits.

- Instant freeze/unfreeze card feature in the app – so if you lose your card, you can block it without having to call and wait on hold. Likewise, if you find your card after, there is no headache unblocking it.

- Unlimited disposable virtual cards that generate unique card details for each online purchase you make.

- Travel perks such as travel insurance and access to airport lounges.

How To Apply For A Revolut Account

What makes digital banks like Revolut so popular is that it is easy to apply for an account with them.

Compared to traditional bank accounts, where you must make an appointment in person, supply mountains of paperwork, and wait weeks to use your account, opening a Revolut account is effortless.

It takes just a few minutes to open a Revolut account, and you can do it directly from your Android or iOS smartphone.

No lengthy phone call, virtual meeting, or back-and-forth emailing is required. Instead, you simply input your details and upload valid identification if needed.

Here’s the exact process to follow to open a Revolut US account:

- Download the app from the Apple or Google Play Store.

- Enter your phone number – You’ll then get sent a verification code that you’ll need to enter to go to the next step.

- Input your personal details, such as name, date of birth, home address, and email address.

- Take a selfie (for identification purposes).

- Create a passcode.

- Choose your plan – Standard, Premium, or Metal – Note that you can upgrade later.

- Choose your card (physical or virtual) – If you choose virtual, your card details are generated immediately.

- That’s it – You’ll now be taken to your account page, but note that you’ll need to confirm your email address, so remember to check your inbox.

How To Use Revolut

So, once you’ve opened your account, how do you use the app?

Here’s what you can start to do straight away:

- Open multiple accounts for different currencies. So if you have clients based in other countries that pay you in their currency, you can instantly open an account to start receiving your salary immediately. There are over 25 currencies you can get paid in, including GBP, Euro, CAD, and AUD.

- Add money to your Revolut account via regular bank transfer, adding your bank card, or via Google Pay.

- Set up for your salary to be paid into your Revolut account – Revolut will share a prepared email that you can send straight to HR to request the change.

- Invite your friends to use Revolut – You’ll receive a cash prize for each friend that signs up, orders a physical card, and makes 3 card payments.

- Make your first transfer by adding your contacts or bank account details, or create a payment link to request payment from your clients.

- Set up monthly or weekly budgets.

- And much more!

Is Revolut Safe?

As digital banks are still relatively new, there are some concerns over how safe they are.

However, Revolut is probably the safest digital bank as it uses award-winning security systems that keep your card details safe, flag any suspicious transactions, and use additional verification processes.

Revolut is a financial technology company. Banking services are provided by Metropolitan Commercial Bank (Member FDIC).

In addition, Revolut offers super secure card options. They use strict data security to store card numbers and offer disposable virtual cards. This works by giving you a temporary card number to use one time on an online purchase.

After you make an online purchase, those card details are destroyed to protect you against online card fraud.

You can request virtual cards without fees and as many times as you like, as the temporary data is generated instantly in the app.

Are There Any Downsides To Revolut USA?

While digital banks have many advantages over traditional ones, such as fast and easy account opening and comprehensive in-app account management, Revolut may not be for everyone.

One thing to note about Revolut is that it is difficult to speak with an actual person if you have issues. Their sole customer service method is through the in-app chat, which is available 24/7. However, there is no telephone support, only an automated number to block your card.

Moreover, as they do not have any physical branches, there is no in-person support either. While this is fine for many people, you may find this frustrating if you like to speak with someone on the phone or in person about your banking problems.

Also, note that customers on the paid plans get priority in the in-app chat. So if you have a standard account, you might have to wait a while to receive a response.

Final Thoughts On Revolut USA

Revolut is more than just a handy traveling tool that makes it easy to withdraw local currency and saves you from extortionary fees.

This innovative digital bank offers something for everyone, including savers, spenders, employees, freelancers, and entrepreneurs.

If you don’t yet have a Revolut account, download the app today and look around.

Revolut doesn’t pressure you to buy a paid plan, so you can try it out and then upgrade to the additional features if you feel they are helpful.

Are you looking for more content about travel finances? Read one of the following guides: