Wondering what’s the differences between Wise and Paypal?

Below, you’ll find our full review on both platforms.

Gone are the days where you relied on high-street banks to send payments overseas or convert your hard-earned cash into travel money.

These days, more and more people are moving away from the excessive exchange rates and fees from traditional banks and opting to do money transactions virtually instead.

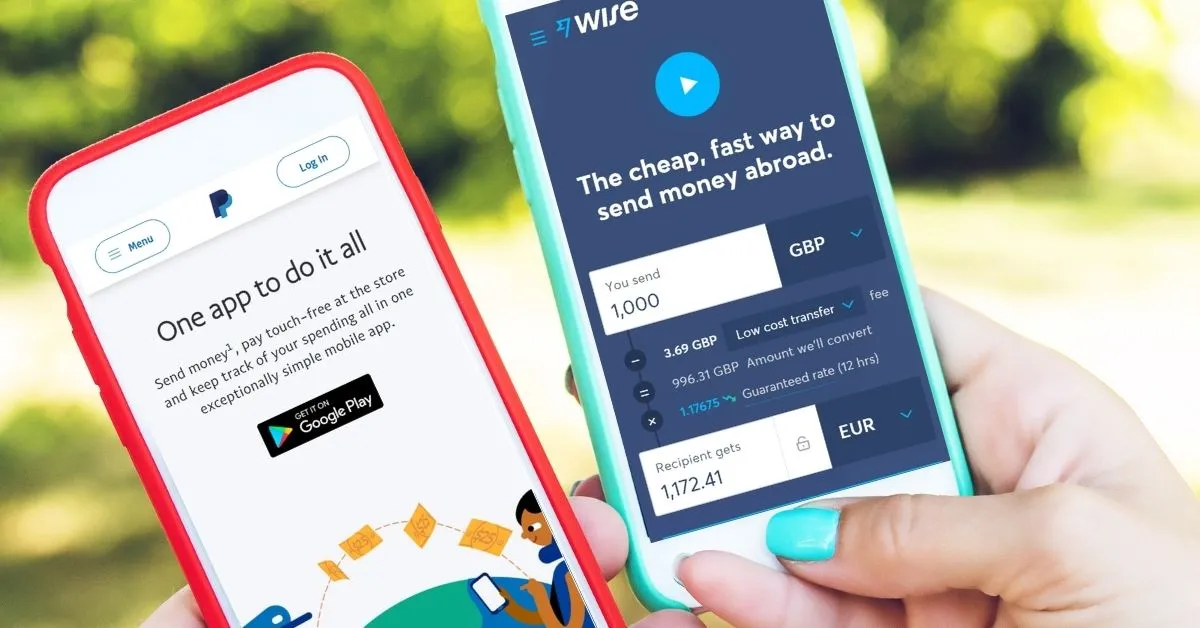

Wise and Paypal are two of the most well-known online financial providers.

However, their services differ pretty significantly, and each has its own advantages and disadvantages.

Perhaps you already have a Paypal account and are considering switching to Wise. Or maybe you have neither and are unsure of whether to choose Wise or Paypal.

To help you make the right decision, we’ve put together a comprehensive Wise vs Paypal comparison guide.

That said, know that you can have both. Both are good in different situations.

What Is Wise?

Wise is an online service for transferring and receiving money from overseas.

The company, previously known as Transferwise, was founded in 2011 in the United Kingdom, offering low exchange rates for travelers and simple money transfer services.

Today, Wise has evolved into a reputable international financial provider that allows you to transfer money to almost 80 countries and hold more than 40 currencies in your virtual wallet.

In addition, Wise makes exchanging currencies quick and effortless, using actual exchange rates with no markup.

Wise is also a popular service provider for remote workers, online business owners, and digital nomads who receive payments from all over the world.

Customers get personal multi-currency bank account details for 9 countries, including the UK, USA, Canada, Australia, and New Zealand, so they can get paid like a local.

Wise customers also get a multi-currency MasterCard, which they can use to withdraw cash in local currency from ATMs.

Plus, Wise allows you to convert your money into local currency on the app first to avoid the high ATM conversion rates.

You can also use the Wise debit card to pay for goods and services in local businesses and online.

You can learn more about Wise in our guide and find out how Wise works.

If you’re a digital nomad or a long-term traveler, you should know that Wise is one of the best banks for digital nomads.

What Is Paypal?

Paypal is the original and most popular online money provider worldwide, founded in the USA in 1998.

Most people use Paypal to pay for goods and services online, as many eCommerce companies offer Paypal as a payment option, such as eBay and Amazon.

Paypal gained the reputation of being a safer way to make payments online as merchants do not see or have access to your bank account details.

However, today the company offers many more services like sending invoices to clients, sending and receiving money from all over the world, splitting bills, and most recently, crypto trading.

What’s more, aside from offering personal accounts for individuals, they also offer business accounts.

This allows companies to keep their business transactions separate from their personal affairs and online merchants to sell securely with Paypal seller protection.

Wise Vs Paypal: Full Comparison

Both providers offer some of the same services and some unique ones. Let’s see how they stack up against each other.

| Information | Wise | Paypal |

| Price to open an account | Free | Free |

| Countries you can open an account from | 70 | 200 |

| Currencies supported | 40+ | 25 |

| International transfer speed | 1-2 business days | Up to 6 business days |

| Cards | Free MasterCard debit card for all users | Offers prepaid cards for personal accounts and debit cards for business accounts |

| Number of users | 10 million | 325 million |

| Crypto trading | No | Yes |

| Support options | Email, live chat, phone | Email, online resources |

Wise Vs Paypal: Exchange Rates

Wise sells currency based on the actual mid-market rate, the one you would see on Google.

They do not add any markup; instead, they make their money from fees (discussed below). Therefore, Wise offers the best exchange rates and is highly transparent too.

For example, you can check how much you will receive on their handy currency calculator. They will also tell you if another provider is currently offering a better price.

What’s more, when the market is closed on the weekend, Wise still honors Friday’s mid-market rate.

PayPal uses a retail exchange rate, which is essentially the rate you get at the airport.

Therefore, Paypal’s conversion rate is very poor, especially compared to Wise’s mid-market rate.

Verdict: This one’s a no-brainer; Wise’s exchange rates are always significantly better than Paypal’s.

Wise Vs Paypal: Fees

Both providers charge fees for transactions. Wise calculate their costs based on a percentage of the transfer amount.

They are evident and transparent about their prices, so you always know exactly how much they charge for each transaction.

PayPal’s fee structure is much more complicated as it depends on the type of transaction, the country you send from, and the country you transfer to.

They offer a fee calculator, but their system is still more challenging to understand than Wise’s. However, there are no fees to send money domestically to friends and family.

Verdict: Paypal has a lot of hidden fees, whereas Wise is transparent and clearly states the prices before you confirm the transaction. It’s also worth noting that Paypal both charges a fee and includes a fee in their exchange rate, whereas Wise doesn’t.

Therefore, Wise may have higher costs at first glance, but overall, transactions are generally cheaper with Wise than with Paypal.

Wise Vs Paypal: Availability

PayPal is available in over 200 countries, whereas Wise is only available in 160+ countries. Additionally, Wise allows you to exchange and send money in over 60 currencies, while Paypal currently supports 25.

However, Paypal will enable you to send money in other currencies using Xoom (an international money transfer service owned by PayPal) that supports over 100 currencies. That said, this is only for personal transfers and not for receiving or sending business payments.

Verdict: Although PayPal is present in more countries than Wise, Wise allows you to send and exchange between many currencies, regardless of what the transfer is for.

Wise Vs Paypal: Safety

Many people would assume that as Paypal is a more established company, they are safer to use. FTC regulates Paypal in the USA, FCA in the UK, and APRA and AUSTRAC in Australia.

They use industry-leading encryption technology” to keep your money safe. However, because of their popularity, they are a higher target for money transfer scams than Wise.

Wise is regulated in all the countries they operate in, such as FINTRAC in Canada, FCA in the UK, ASIC, APRA, and AUSTRAC in Australia.

Neither Wise nor Paypal are a bank, but they do partner with banks. Wise is required to safeguard your money by holding it in established institutions like JP Morgan, Chase, and Barclays.

Paypal partners with banks to offer their prepaid cards, credit cards, and other financial products.

Verdict: Both Wise and Paypal are highly regulated and have high safety measures in place.

Wise Vs Paypal: Customer Satisfaction

Even though Paypal has been around for longer and has considerably more customers than Wise, they seem to have more unhappy customers.

For example, wise has an excellent rating of 4.6 out of 5 on Trustpilot with over 110,000 reviews.

In contrast, Paypal has an abysmal Trustpilot rating of 1.2 out of 5 with only 18,000 reviews. What’s more, Monito scored Wise a rating of 9.5 and Paypal a much lower rating of 5.4.

Most of Paypal’s negative reviews are around business users having their accounts locked for no reason and being unable to withdraw money because of this.

Paypal customers are also unhappy about the company’s poor customer service and generic responses.

Some Wise customers have also reported unexpected account blocks without any reason given.

Verdict: Comparing Paypal vs Wise, you can see a striking difference in customer satisfaction. Although Wise isn’t perfect, they seem to have happier customers.

Wise Vs Paypal: Features

Wise focuses mainly on international currency transfers, and you could say that they limit themselves.

On the other hand, Paypal offers tons of features, but of course, they have been operating for a lot longer than Wise and have expanded over time.

Some of Paypal’s top features include sending invoices, making donations, splitting bills, and their PayPal Checkout add-on. In 2021, they also introduced crypto trading.

We particularly like two of Wise’s features; their multi-currency wallet that allows you to hold multiple currencies at once and their Mastercard that works globally.

With the Wise MasterCard, you can withdraw from ATMs and pay for goods. In addition, every customer receives a debit card when they sign up for a Wise account. In contrast, Paypal customers need to order a Paypal reloadable card.

Verdict: Paypal offers different features for sending and receiving funds between family, friends, and businesses.

Paypal Vs Wise: Our Verdict

Deciding between Paypal vs Wise comes down to your specific needs.

For example, Wise promotes cost savings and fee transparency and, thus, offers cheaper money transfers.

On the other hand, Paypal integrates eCommerce online payments, offering the safest online shopping experience.

What’s more, Paypal seems to be the best option if you only make domestic transfers as they do not charge for these transactions.

However, Wise is undoubtedly the cheapest and best choice if you’re sending and receiving money internationally.

I personally use both for different purposes. Having a Paypal account is helpful for online shopping or subscription-based memberships.

As so many businesses and people use Paypal, it’s usually easier to do transactions via Paypal.

Although, over the years, more and more people have created Wise accounts, and it has become my favorite way to do international transfers.

I use both Wise and Paypal every week.

Are you interested in comparing Wise and Revolut digital bank? Read our comparison between Revolut and Wise.