Already abroad? Did you realize you left without travel insurance? Or did you forget to renew your travel insurance? Finding travel insurance after departure can be tricky.

Many travel insurance companies don’t allow you to buy insurance once you have left. We found two companies that allow you to buy insurance after departure.

Note that there are more than two, but most companies are restricted to a region, and since you guys come from different countries, I thought I should focus on the global ones.

In this guide, we’ll talk about SafetyWing, Genki, and Heymondo.

SafetyWing

Buying post-departure travel insurance could not be any easier with SafetyWing.

In fact, if you are from Canada, Australia, or the states of Washington, Maryland, or New York; you can ONLY purchase SafetyWing Insurance after you have left the country.

As I said, many companies don’t allow you to purchase insurance after departure.

How Much Does It Cost?

SafetyWing medical insurance starts at $45.08 for 4 weeks(28 days), and you can either put an end date on your coverage OR subscribe for automatic monthly renewals so that you won’t go a day without your insurance.

Children under the age of 10 can be added to a group plan for free (limited to 2 children per group).

How To Sign Up

Once you have created an account with SafetyWing and filled in your personal information, such as your name, home address, and country; you can register for travel insurance easily for all of your future adventures.

Signing up for SafetyWing travel insurance is done in five easy steps:

- Insurance – Choose whether you need coverage up until a specific date or indefinitely

- Destinations – Select all of the countries that you plan on visiting if you are not sure where your travels are going to take you, no worries! Just choose your first stop and any others if you need to prove you have travel insurance for a visa to those countries.

- Group members – If you are making a group trip with friends with matching passports, you can get SafetyWing travel insurance for the whole group all at once. The price doesn’t change, but it is much more convenient to have your insurance details all in one place.

- Summary – Double-check all of your information to avoid any complications if you need to make a claim.

- Payment – SafetyWing accepts Visa, Mastercard, American Express, and Discover Card through their secure web-payment system.

Why Choose SafetyWing

SafetyWing is easy to understand, sign up for, and file a claim.

They also have an agreement with multiple hospitals both outside and inside the US where you can file a claim directly through your insurance, which means you won’t have to pay upfront for your medical services.

They also include coverage for your short visits home. For all countries except the United States, you will be secure for 30 days within a 90-day period, whereas American citizens are insured for 15 days.

If you wish to learn more, you can read our complete review of SafetyWing.

Some Downsides To SafetyWing

There are not many downsides to choosing SafetyWing, but the key thing to note is that they do not service the countries of North Korea, Cuba, and Iran.

They also only provide insurance for people up to the age of 69.

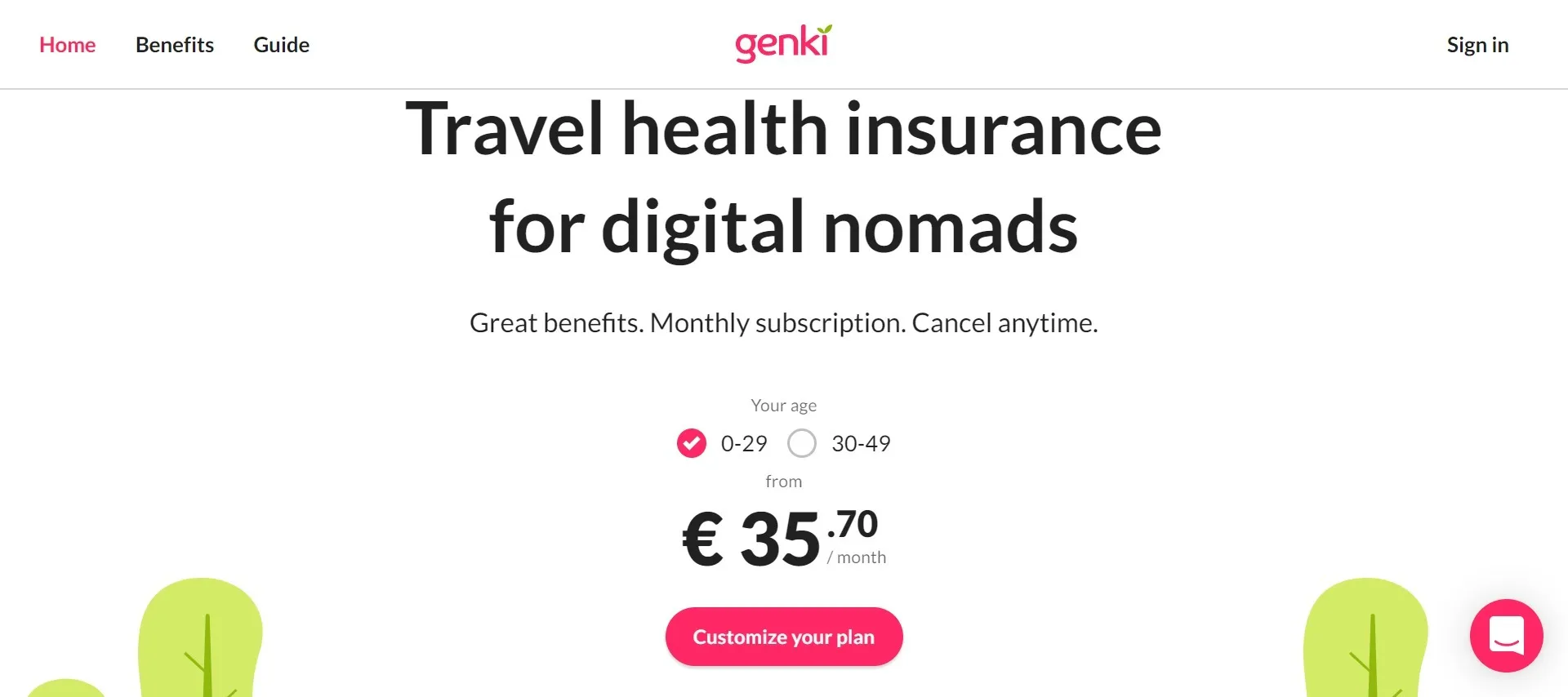

Genki World Explorer

Genki provides health insurance for long-term travelers such as digital nomads and backpackers.

You can get coverage from one month up to two years with a monthly subscription that you can cancel anytime.

Their pricing depends on three main things:

- Your age

- The region you’re visiting

- The deductible you choose

Let’s dive deeper into their coverage options.

Genki covers medical treatment, Covid-19 treatments, sports injuries (take a look at the exclusions), assistance, hospital visits, medical transport, repatriation, pregnancy, emergency dental treatment, initial mental issue treatment, etc.

You can learn more by reading the conditions and coverage on their website.

How Much Does It Cost?

Genki offers monthly subscriptions starting at €35.70 per month.

Your age, destination, and plan chosen will influence the price.

You can cancel anytime, which is great if you don’t know how long your trip will be.

How To Sign Up

To sign up on Genki, head to their website and enter your information. You’ll be able to choose a few options.

Regarding deductibles, you’ll get two options:

- Everything will be paid in full.

- A deductible of €50 will apply per case.

When it comes to destinations, let’s take a look at your options:

- Worldwide: You are covered everywhere, but the coverage in your home country is limited.

- Worldwide excluding Canada & USA: Like the Worldwide option but with cover in Canada and the USA limited to 6 weeks per 180 days.

Why Choose Genki

I like how Genki offers you options to curate a plan that suits your budget and needs.

In the end, Genki might be a cheaper option if you’re less than 30 years old.

I believe their coverage might even be better than Safety Wing, but it’s still a new company, so it’s worth comparing both to see what suits you better.

Some Downsides To Genki

As I just mentioned, Genki is a newer health insurance provider, and while it looks promising, it doesn’t have the same popularity as SafetyWing.

That said, it’s worth comparing both products to find one that suits you.

Heymondo

Heymondo provides tailor-made travel insurance for short-term and long-term travelers.

They offer different types of insurance:

- Single trip

- Annual multi-trip

- Long stay

The price can change depending on your home country, destination, and plan type chosen.

You can get a free quote on Heymondo by picking a plan and entering your country of residence, destination, and departure dates.

You can learn more by reading the conditions and coverage on their website or our Heymondo review.

How Much Does It Cost?

The pricing depends on your trip, regions covered, and chosen options. The cost can change from one trip to another depending on your nationality, and so on.

So, the best way to find the correct pricing is to go to their website and calculate the quote for your specific needs.

The good news is that our readers get 5% off on their plans. By using our links, you’ll get the discount automatically.

How To Sign Up

To purchase a plan on Heymondo, head to their website and enter your information. You’ll be able to choose between different plans, so make sure to pick the one that suits your needs.

When it comes to coverage, you get to choose between different options:

- Specific country

- Europe

- World, including Canada and USA

- World, excluding Canada and USA

Why Choose Heymondo

I like that Heymondo offers different plans to suit different types of travelers. You can find an option that suits your budget and trip even if you’re already abroad.

You’ll also get access to an exclusive app so that you can get the help you need during your trip.

Some Downsides To Heymondo

Heymondo only offers coverage abroad, so you won’t be covered in your home country. While this may be an issue for some people, it might be okay with you.

Final Thoughts On Travel Insurance After Departure

Travel insurance is a must for any traveler. It can provide peace of mind if something goes wrong while you are on your trip.

Make sure to purchase travel insurance before you leave, and read the policy carefully to understand what is covered.

That said, if you forget to buy it before your trip, you’ll be able to buy it after departure.

If something does happen while you are away, make sure to contact the insurance company as soon as possible.

That said, if you forgot to purchase insurance before your departure, don’t worry. You still have options like the ones mentioned above.

Traveling soon? Read one of the following guides: