Are you ready to open a bank account in Thailand? You’re about to embark on an exciting journey that will make your life easier, and let you save money.

But before you get started, there’s one thing you should know: it can be a bit tricky at times!

Ready To Travel? Don't Go Without Travel Insurance.

I recommend SafetyWing Nomad Insurance, an affordable travel insurance offering automatic monthly payments that you can cancel anytime. I've been using it since 2019, and I can assure you it's the perfect solution for nomads like you and me. Learn more by reading our SafetyWing review.From paperwork requirements to language barriers to cultural differences, opening up a bank account in Thailand isn’t always straightforward.

But don’t worry — we’ve got all the tips and tricks you need so that navigating this process is as easy as possible.

Before we get started, you should note that I opened a bank account in Chiang Mai, so you may face some minor differences if you open a bank account somewhere else in Thailand.

In this guide, we’ll cover all things related to banking in Thailand.

So buckle up and get ready to learn how to open a bank account in Thailand!

Best Banks In Thailand For Foreigners

If you decide to open a bank account in Thailand, you may be wondering which bank is best for foreigners.

When we asked agencies, we were told Bangkok Bank and Kasikorn Bank were the best options for foreigners.

After a quick search in Facebook groups for expats in Thailand, it seemed that Bangkok Bank was the best bank for foreigners, so we decided to go for Bangkok Bank.

Now, you should know that there are many others banks in Thailand to consider, but it’s not always easy to open a bank account abroad, so we thought it’d be better to pick an easy and fast option.

Process Of Opening A Bank Account In Thailand

Opening a bank account in Thailand is easy as long as you have all the correct documents. Let’s take a look at the documents needed first.

Documents Required By The Bank

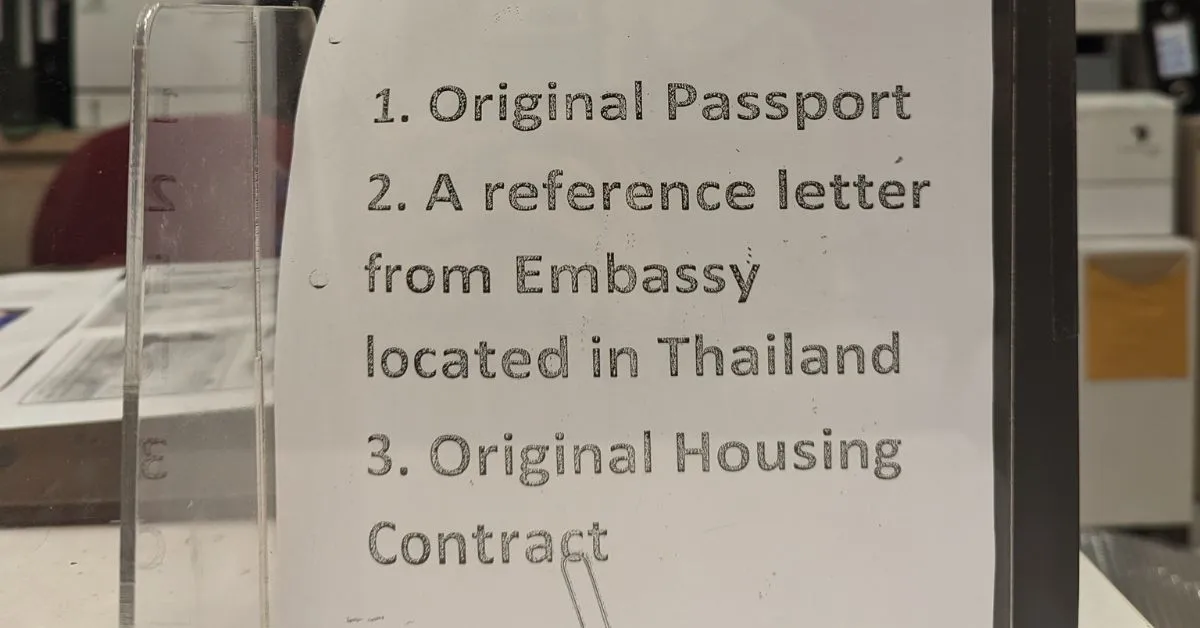

To open a bank account, you’ll need the following documents:

- Residence certificate (learn how to get the residence certificate in Chiang Mai)

- Passport

- Lease agreement

You don’t need to bring copies of your passport or your lease, as the bank officer can make copies directly at the bank. However, it’s important to note that the officer will take the original residence certificate.

Remember to bring money with you, as you’ll need to make a deposit and pay a small fee to get a bank card.

Process

- Pick a bank nearby, and when you get there, you may need to pick a queue number to open a bank account. Make sure you have all the right documents with you (see the list above).

- When your number is called, go to the office and request to open a bank account. The officer will ask for your documents and give you paperwork to fill out.

- The officer will ask you which types of banking services you’ll need. We asked for a debit card and access to a mobile banking app.

- Pay the fee to open the bank account (fee, card, insurance, and deposit).

- Sign a lot of documents.

- Decide on a beneficiary.

- Set up your PIN for the mobile banking app, and for the bank card.

- And there you have it. You now have a Thai bank account.

Now, it’s essential to know that opening a bank account can be long, so bring your best self and patience along.

Keep reading to learn about my experience opening a bank account in Chiang Mai, Thailand.

My Experience Opening A Bank Account In Chiang Mai

My partner and I decided to open a bank account at Bangkok Bank in Central Festival in Chiang Mai.

On our first attempt, we had to wait one hour for our number to get called, and then, the officer disapproved of our lease agreement as there was a page that the landlord didn’t sign.

The next day, we came back with a correct copy of the lease. We had to wait another hour for our number to get called.

As I was there with my partner, we had to open two Thai bank accounts, and the whole process took around 1h30. In the end, we were at the bank for quite a while.

When we left, we already had access to the mobile banking app, a bank card, and money in our bank account.

We both had to pay THB 1,800. This fee includes insurance for one year and a bank card.

The next day, I transferred money to my Thai bank account with Wise, and it worked instantly.

Online Banking In Thailand

Each bank has its own online banking app, but most are similar.

With your app, you can:

- Transfer money to other bank accounts in Thailand.

- Pay bills.

- Scan QR codes.

- Withdraw money in ATMs.

- Etc.

ATMs In Thailand

You can find ATMs all over Thailand, and you may use them to:

- Withdraw money from your Thai bank account.

- Withdraw cash from your travel card. For example, you can withdraw money with Revolut in Thailand.

- Check your balance.

- Change your PIN code.

- Etc.

Read our guide to learn more about money in Thailand.

Banking Alternatives For Foreigners In Thailand

In addition to banks, there are other banking alternatives for foreigners in Thailand.

Here are some other ways you can get, withdraw or transfer money in Thailand:

- Wise – A fast and secure way to transfer money from one currency to another. For example, I use Wise to transfer money to my Thai bank account.

- MoneyGram – Another safe service that allows you to send money in minutes.

- PayPal – You may use PayPal to receive money from abroad and to send payments.

- Revolut – You can also open a Revolut account and use it in Thailand. It’s great for traveling abroad, as you can access multiple currencies and extra perks. Learn more about the Revolut travel card.

Final Thoughts About Opening A Bank Account In Thailand

Opening a bank account in Thailand can save you a lot of time and money. With an account, you’ll have access to more banking services, and you’ll be able to transfer, withdraw and receive money with ease.

For a smooth experience, make sure to have all the documents you need with you when visiting the bank.

It’s also important to understand the fees associated with opening an account and any services you may need. So, make sure to bring money too.

Traveling to Thailand soon? Read one of the following guides: