There are so many things to think about when you’re traveling or living abroad. Accommodation, transport, and even where to go are just a few.

Travel insurance for nomads is something that people often overlook and don’t realize they need it until they actually need it!

However, it is so essential for travelers and digital nomads alike. It’s recommended to buy travel insurance before you leave, but some companies let you buy it once you’re abroad.

Especially during these unknown times, wherever you are in the world, you want to make sure you are prepared. Having health insurance, travel insurance, or both is a great start to keeping yourself safe.

There are tons of health and travel insurance options out there, so it can get overwhelming when it comes time to choose one. In this article, I will talk about Safety Wing, Genki and Heymondo.

Not all plans are created the same, so you should check what each policy covers and does not cover. The price of a plan will also depend on your age, home country, and where you are traveling.

How you tailor your policy, such as add-ons, will also affect the cost.

SafetyWing Nomad Insurance

Nomad Insurance is SafetyWing’s original travel health insurance plan. Nomad Insurance covers medical and travel costs. You are covered for travel anywhere in the world outside of your home country.

Travel costs include things such as travel delays, lost luggage, personal liability, and natural disasters – most of the things that could ruin a trip.

Learn more by reading our complete Safetywing review.

Medical costs cover if you get sick or have an accident. Nomad Insurance is available as a short-term plan if you are traveling around.

You can also set up monthly payments until you pick an end date, so you are always covered! It should be noted that Nomad Insurance is not primary health insurance.

COVID-19 is finally covered under Nomad Insurance, and if you’re already abroad, you can still sign up for Nomad Insurance to cover the rest of your trip.

Here’s how it works in a nutshell:

- You must have Nomad Insurance for a minimum of 28 days.

- You are outside of your home country.

- Your quarantine is mandated by a physician or governmental authority, because you have either tested positive for COVID-19 OR you are symptomatic and waiting for your test results.

- Planned hotel quarantine is not covered. If you test negative or you do not have symptoms, quarantine is not covered.

- You can claim quarantine coverage of $50/day for up to 10 days (with the limitation of being once within a 364-day period).

Genki World Explorer

Genki provides health insurance for long-term travelers such as digital nomads and backpackers. You can get coverage from one month up to two years with a monthly subscription that you can cancel anytime.

Their pricing depends on three main things:

- Your age

- The region you’re visiting

- The deductible you choose

Let’s dive deeper into their coverage options.

Genki covers medical treatment, Covid-19 treatments, sports injuries (take a look at the exclusions), assistance, hospital visits, medical transport, repatriation, pregnancy, emergency dental treatment, initial mental issue treatment, etc.

You can learn more by reading the conditions and coverage on their website.

Regarding deductibles, you’ll get two options:

- Everything will be paid in full.

- A deductible of €50 will apply per case.

When it comes to destinations, let’s take a look at your options:

- Worldwide: You are covered everywhere, but the coverage in your home country is limited.

- Worldwide excluding Canada & USA: Like the Worldwide option but with cover in Canada and the USA limited to 6 weeks per 180 days.

Heymondo Long Stay

Heymondo offers multiple plans for short-term and long-term travelers, but if you are a digital nomad, the Long Stay plan could be a great option to consider.

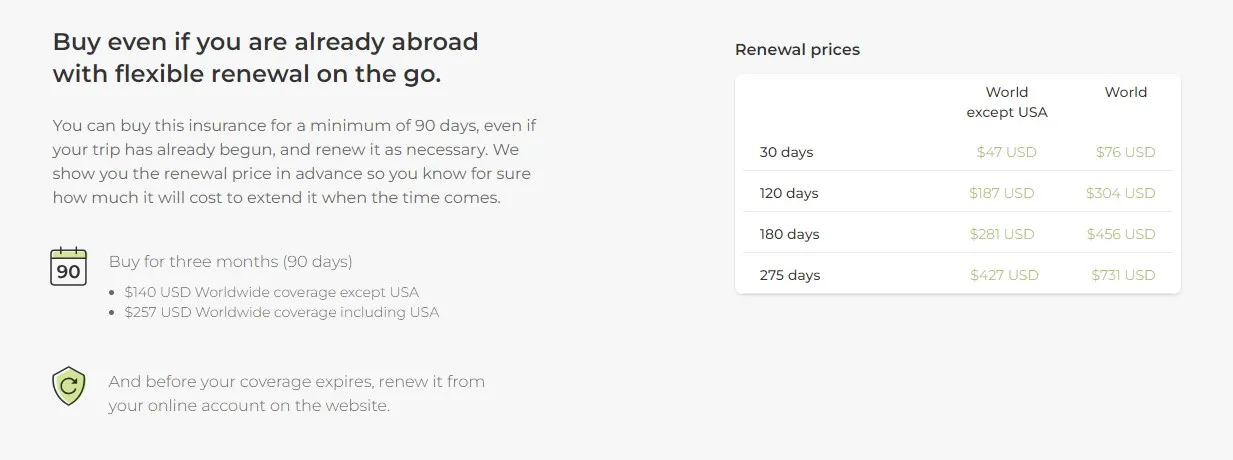

You can buy this insurance plan for a minimum of 90 days, even if your trip has already begun, and renew it as necessary on the go.

Here’s an overview of what’s covered in the Heymondo long-stay plan:

- Emergency medical and dental expenses overseas

- Medical transportation and repatriation home

- Baggage loss or damage

- Trip cancellation and interruption

- Travel disruption

- Electronic equipment (optional)

- Adventure sport (optional)

- Cruise (optional)

Some elements come with limits, so make sure to keep that in mind when purchasing a plan.

If you wish to learn more about the policy, you can read the full details on Heymondo’s website.

However, if you need coverage in your home country, you should know that Heymondo won’t cover anything happening there.

Final Thoughts On Travel Insurance For Nomads

Digital nomads must be especially careful when choosing a travel insurance policy, as not all policies are created equal.

Make sure you know what is and isn’t covered by your policy before you leave on your next trip.

Also, read the fine print to understand any exclusions or limitations.

If something happens while you’re away from home, make sure to contact your insurance company as soon as possible to start the claims process.

Traveling soon? Read one of the following guides: