As you’re planning the trip of a lifetime, you’re already getting excited about the destinations you’re about to discover. Now is when you have to spend money again on travel insurance.

Depending on where you’re from, you might be aware of different travel insurance companies. Although, when it comes to long-term travel, long backpacking trips, or digital nomad trips, these classic companies might not fit your needs.

There is a few popular providers for long-term travelers.

In this post, I’ll give you information about SafetyWing so that you can see if it fits your needs, but we’ll also talk about Genki, and Heymondo which are also great for long-term travelers.

At the end of this post, I’ll be answering any questions you may have regarding travel insurance and long trips.

I know – buying a digital nomad or backpacker travel insurance isn’t that fun. So, let’s try to keep it simple!

Pros and Cons of Buying a Travel Insurance

Travel insurance is one of those things that you don’t realize you need it until you really really need it. Like being in a hospital bed in a foreign country faced with a $12,000 bill, need it.

As the saying goes, if you can afford to travel, you can afford to purchase travel insurance!

Pros of purchasing travel insurance

When sh*t hits the fan, you’re covered. As much as you think you are, you’re not bulletproof, and you’re not immune to Murphy’s Law.

Unfortunately, things happen, and I’d hate for you to have to return home only one month into your trip because of an emptied-out bank account due to an unexpected hospital visit.

That said, it’s important to know that you won’t necessarily need insurance during your trip. And that would be good news! It’s more about making sure you’re covered in case you need it.

This post is not about convincing you to get insurance, but about showing you different options if you feel like it’s the best choice for you.

Cons of purchasing travel insurance

It costs money. Do you know what else costs money? Contracting malaria or the bird flu while in Vietnam and racking up a hefty hospital bill that you can’t afford.

So, which carrier provides the best long-term travel insurance out there? Introducing…the battle of long-term travel insurance providers.

SafetyWing Nomad Insurance

SafetyWing is hot off the press regarding long-term travel medical insurance. Although new, SafetyWing is backed by some of the biggest insurance companies around.

Their slogan is “for nomads, by nomads” so one can only guess it’s excellent travel medical insurance for digital nomads. At the price point, it’s also the perfect cheap backpacker travel medical insurance, too!

SafetyWing has really come in to shake up the travel medical insurance game and here are some important points to note about this long trip travel insurance company:

SafetyWing Travel Medical Insurance Pros

- Price point. Coming in at $45.08 USD/month, SafetyWing is one of the cheapest long-term travel medical insurance options out there. If traveling in the US, it goes up to $83.44/month, which is still cheaper than most high-level health insurances. Worth it.

- Can be purchased while on the road. I get it. Pre-trip butterflies mean often forgetting things on your pre-travel checklist. If you fly into your destination and have a lightbulb moment that you forgot to purchase travel insurance, you’re in luck. You can purchase a plan at SafetyWing at any point of your travels. Pre-departure or 3 months in, it’s available to you. Learn more about purchasing insurance after departure.

SafetyWing Travel Medical Insurance Cons

- The deductible is relatively high. This means you’ll need to pay a fee to be covered. Depending on your destination, it might be worth it still. That said, you can read our SafetyWing review if you wish to learn more.

What’s covered by SafetyWing travel & health insurance

- Hospital coverage for illness or injury

- Urgent-care

- Prescribed medicines

- Physical therapy and chiropractic care

- Emergency dental

- Lost luggage (but not pricey electronics)

- Travel interruption/delay

- Natural disaster (a new place to stay)

Genki World Explorer

Genki provides health insurance for long-term travelers such as digital nomads and backpackers. You can get coverage from one month up to two years with a monthly subscription that you can cancel anytime.

Their pricing depends on three main things:

- Your age

- The region you’re visiting

- The deductible you choose

Regarding deductibles, you’ll get two options:

- Everything will be paid in full.

- A deductible of €50 will apply per case.

When it comes to destinations, let’s take a look at your options:

- Worldwide: You are covered everywhere, but the coverage in your home country is limited.

- Worldwide excluding Canada & USA: Like the Worldwide option but with cover in Canada and the USA limited to 6 weeks per 180 days.

Genki Insurance Pros

- Price point. The plans start at €35.70 per month if you’re between 0 and 29 years old. If you’re between 30 and 49, plans start at €54.60 per month. Now, the pricing will change depending on the destinations covered and the options chosen.

- Can be canceled anytime. This can be quite practical if you don’t know how long you plan to travel.

Genki Insurance Cons

- It’s still new. Which means it’s hard to tell how good they will be in the long-run. You got to try it for yourself and see if it works. I have to say that even though, they are pretty new, they sound pretty promising to me.

What’s covered by Genki insurance

Let’s dive deeper into their coverage options.

Genki covers:

- Medical treatment

- Covid-19 treatments

- Sports injuries (take a look at the exclusions)

- Assistance

- Hospital visits

- Medical transport

- Repatriation

- Pregnancy

- Emergency dental treatment

- Initial mental issue treatment

- Etc.

You can learn more by reading the conditions and coverage on their website.

Heymondo Long Stay

Heymondo is a travel insurance provider that focuses on tailor-made insurance so that you can get the best value for your money.

They offer different types of insurance:

- Single trip

- Annual multi-trip

- Long stay

For long-term travelers, the long-stay plan is the best option. Let’s have a look.

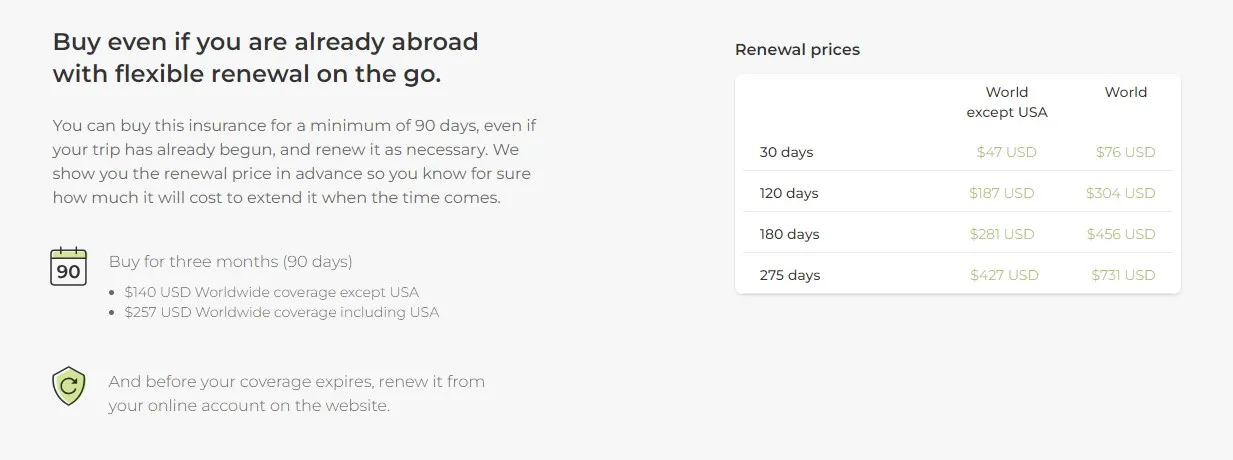

You can buy this insurance plan for a minimum of 90 days, even if your trip has already begun, and renew it as necessary on the go.

Heymondo Insurance Pros

- Price point. The plans are slightly more expensive than the other providers listed here, but it still is affordable. Considering the plans are comprehensive, it is a great option to consider. Our readers get 5% off by using our links to purchase a plan.

- Get help anytime. You’ll get access to an exclusive app so that you can get the help you need during your trip.

Heymondo Insurance Cons

- You won’t be covered in your home country. This can be an issue for some, but not for everyone. For example, if you’re a digital nomad who visits home once or twice each year and needs coverage during your visits, this could be a problem. However, if you don’t need coverage at home, you won’t be affected by this.

What’s covered by Heymondo insurance

Let’s dive deeper into their coverage options.

Some elements come with limits, so make sure to keep that in mind when purchasing a plan.

- Emergency medical and dental expenses overseas

- Medical transportation and repatriation home

- Baggage loss or damage

- Trip cancellation and interruption

- Travel disruption

- Electronic equipment (optional)

- Adventure sport (optional)

- Cruise (optional)

If you wish to learn more about the policy, you can read the full details on Heymondo’s website. When starting the free quote, you can see all terms and conditions.

Read our complete Heymondo review to learn more.

Things To Consider When Buying Your Travel Insurance

If you’re still undecided on which insurance could be the best option for you, here are the things you should keep in mind. Note: you should also read the full policies to be fully aware before making any rushed decisions.

- Where are you going to travel? Some countries are more pricey regarding medical bills (the United States for example). Are you going to the other side of the world? Are you heading to Southeast Asia? Some countries have more risks in terms of bacterias, viruses, etc. These are all things to keep in mind when choosing your travel insurance.

- Do you currently have health insurance at home? Some providers are pretty flexible, and some others aren’t. When getting your quote, give accurate information to see if you can access the insurance coverage with your current situation.

- Are you going to travel short-term or long-term? If you’re moving to another country or if you go on one-week holiday will definitely influence the cost of your travel insurance.

- Will you drive a scooter/motorbike? Will you dive? Or will you do anything “crazy”? You should make sure your insurance will cover you in any potential situations.

- Will you travel with valuables? Are you planning on insuring them?

- Do you have any ongoing medical conditions?

FAQ about Travel Insurance

Now, let’s have a quick look at the popular questions regarding travel insurance.

What’s the difference between travel insurance and health insurance?

Travel insurance is for what I would call “holiday people” which refers to travelers who visit a destination temporarily and then head back home. The travel insurance covers them for medical emergencies abroad, cancellations and possibly personal belongings depending on the plan they chose.

Health insurance is also what you have at home or what you could have if you’re an expat in a foreign country. The health insurance isn’t only for emergencies for also covers you for a chronic illness or ongoing treatments. It allows you to get regular check-ups too.

Can you buy travel insurance whilst abroad?

Depending on the providers and companies you decide to go with, you can or you can’t. It can also be a bit more pricey when you do this. Although, SafetyWing offers this option.

Ideally, you should buy your travel insurance before leaving your country. You never know when an incident could occur.

Can you cancel travel insurance?

Depending on your provider, you might be able to cancel your travel insurance within a time period. Before buying your travel insurance, make sure to know until when you can cancel your policy.

Real-Life Examples & Medical Travel Stories

Up to this day, I didn’t have any medical emergencies that required going to the hospital, but I also had a few minor injuries or problems abroad. Although, you should know I try to be very cautious when I’m abroad and I also am sober, which means, I know how to stay out of trouble! That being said, I’m not a superhero, which means anything could happen at any time. Knocking wood.

Some of my friends abroad weren’t that lucky though. So let’s talk about real stories from my experiences and from friend’s experiences.

After almost 5 years of traveling the world, I had a few minor injuries or problems. None of them required me to use travel insurance or to go see a doctor, but you can judge for yourself! (To be fair – I hate doctors, ha, so I’m good at avoiding them.)

- I had a big eye infection (which created a small ulcer in my eye) – drops with antibiotics and a big break of contact lens helped.

- I had an ear infection after a surfing trip in Indonesia which became a throat infection later on.

- I had head lice (I know, ew.) in Indonesia (I guess the helmets didn’t help here.)

- I had another eye infection in Malaysia a few years later.

- I had a UTI in the UK (I managed to get a prescription for antibiotics without seeing a doctor).

- I had my finger squeezed in a chair in Portugal which resulted in a very swollen finger.

- I had a toe injury in Portugal (no idea how it happened).

- I had very bad food poisoning in Indonesia.

It doesn’t sound this fun, right? If you’re wondering why I didn’t see a doctor – well, in Indonesia, you can get antibiotics at the pharmacy without a prescription – so I skipped the prescription part. In Portugal, I was living with a pharmacist, which means, my friend gave me recommendations. Then, in the UK, I was living with a family who had a family doctor, which they contacted for me. Basically – I was pretty lucky.

Over the years, and especially in Southeast Asia, I witnessed a lot of incidents as well as scooter crash.

Here are friend’s stories abroad:

- My friend got a very bad scooter crash in Bali. A lot of my friends had a scooter crash in Bali. I can count at least 5 close friends.

- My friend has a bad UTI, which became a bad kidney infection later on in Indonesia.

- My friend got a viral infection while doing her divemaster course in Indonesia. She had to fly back home eventually because she was too sick.

- My friend hit the reef while surfing in Indonesia, and he had to get plastic surgery after the incident as his face was destroyed.

- My friend got stitches after a surfboard hit his forehead in Indonesia.

- My friend got dengue fever in Thailand.

- My friend got stung very badly by a jellyfish in Malaysia.

And I probably forget some stories here. I also remember a story in the Philippines when someone from the hostel got a perforated foot from jumping in the water. It turned out, he jumped on an anchor.

Remember the saying Better Be Safe Than Sorry? Well – sometimes it’s better to be safe.

Final Thoughts On Insurance For Long-Term Travelers

I personally think SafetyWing is the best option for long-term travelers. I’ve been using it for several years now, and it’s been great. But, I have to say that Genki seems promising too. If you’re traveling for a few months and don’t need coverage at home, it’s worth checking Heymondo too.

Remember the saying Better Be Safe Than Sorry? Well – sometimes it’s better to be safe.

Traveling soon? You might also like the following: