Traveling isn’t always cheap and many travelers postpone their travel plans due to insufficient savings. Saving money for traveling can often be quite challenging. At the end of the day, many travelers prefer to spend money on stuff we see right away rather than future travel experiences.

One way to save money for your travels is the 52-Week Money Saving Challenge. In this article, Jakub Krejci – a digital nomad who invest money to generate passive income – will show you how it works and how you can use it to save money for your next trip.

Read until the end to find out how you can hack your 52-Week Challenge and save even more money.

52-Week Money Saving Challenge – How Does it Work?

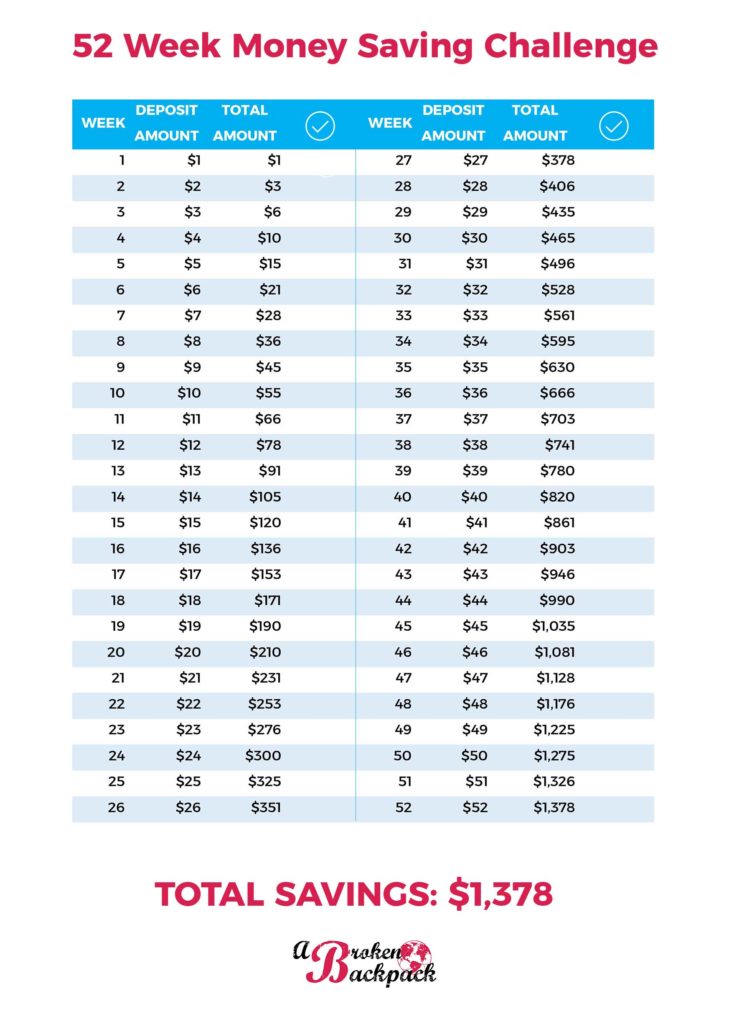

The strategy is simple: Every week you put away one additional dollar into your savings. In the first week, you save $1, in the second week $2, in the third week $3 and so on. At the end of your 52-Week Money Saving Challenge you will have saved up $1,378 towards your travel plans.

In order to follow through the plan, I suggest to print out this table and put a checkmark after each completed week. That way you will be more accountable and won’t miss your saving schedule. Print it out here.

Hack Your Money Saving Challenge With P2P Lending

If you want to save an additional $132 you can invest your savings in various P2P lending platforms instead of transferring it to your savings account. Let’s see how this works.

What is P2P?

P2P lending is a form of investment, where people like you and I invest in loans of other people. This investment strategy is very popular amongst European investors. People sign up on various P2P lending platforms, invest money and earn interest.

Even though it’s popular in Europe, investors can come from various countries. As long as you have a EUR account you can invest. For example, you can have a multi-currency account with Wise and invest in P2P platforms without trouble.

Why use P2P Lending to Hack Your Money-Saving Challenge

There are a few reasons why you should use P2P to save more money for your upcoming adventures.

- Earn additional interest on your savings

- Get platform cashback from 0,5% to 1% on your investment

- Saving your money in a piggy bank will, in fact, lower the value due to the inflation

These are the three main benefits you will get when investing in P2P loans during your 52-Week Money Saving Challenge.

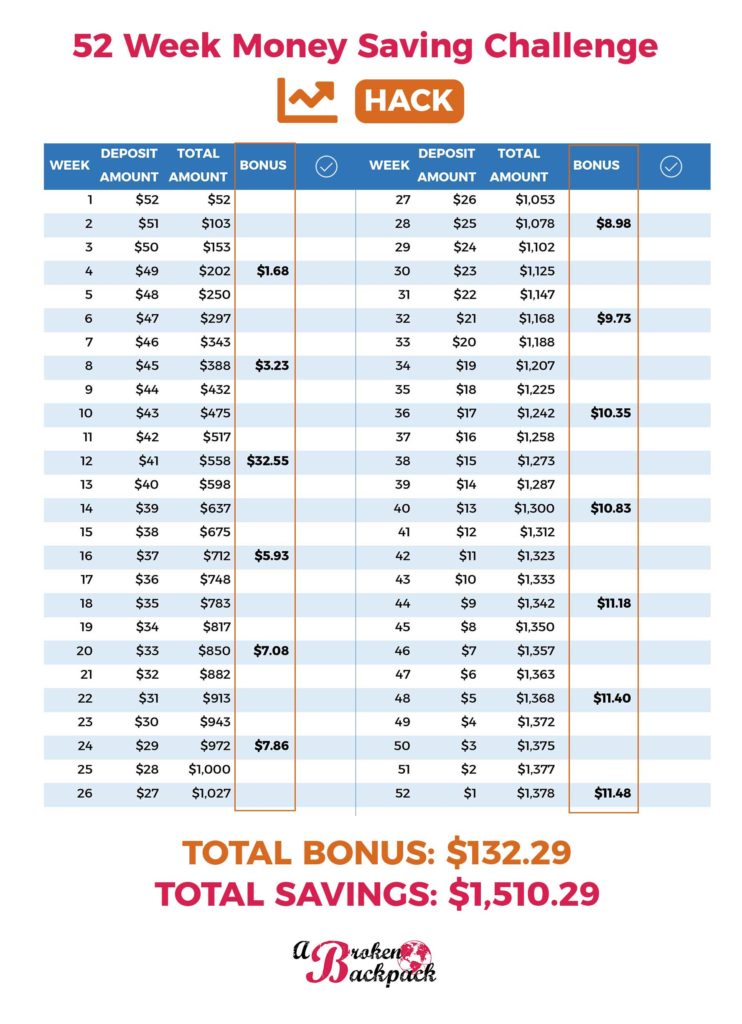

Here is an example of how your saving schedule can look like. Note that this is just an example. The bonus amount depends on factors such as the deposit amount, interest and cashback amount.

In this example, I am assuming that you are receiving 11% interest per year and a sign-up cashback of 0,5% after 90 days of investing in the P2P platform. You will also be doing the challenge backward as this will give you more bonus on your savings.

To put it simply, each month you will receive interest for your investment. In the 12th week, you get an additional bonus of 0,5% from $558 with the monthly interest. You can also print this table here.

Does this really work?

Yes, trust me. I have been investing in P2P loans since 2017 and I use it to earn additional income so I can finance my travel adventures. You can read more about how to start investing in P2P loans on my blog kubasjourneys.com.

If you want to get similar results as in the above-mentioned example, read this EstateGuru review to learn exactly how to set it up. This P2P lending platform allows investors from all around the world, even the US or UK, to invest in to secure real estate loans. Read more about it on my blog.

Drawbacks with P2P lending

If you ask me, there are more pros than cons to P2P lending, however, you should be aware of a few things when hacking your 52-Week Money Saving Challenge.

Higher risk: P2P lending comes with a higher risk than saving your money under the pillow. Make sure to invest in platforms that offer good protection for your investment. (For example, EstateGuru has a lower risk when it comes to investing.)

Liquidity: In most cases, you can access your money on your savings account anytime. On P2P platforms, you need to wait until the end of your investment period to withdraw your money.

Tips for your 52-Week Money Saving Challenge

Make yourself accountable

Being accountable for your actions is the key to successfully completing your 52-Week Money Saving Challenge. Always remind yourself about your long-term financial goals and why you started with the money-saving challenge in the first place.

Put your money on a separate account

To automate your savings schedule, simply set up weekly recurring transfers to your savings account. If you use one of the digital banks such as Revolut you can use functions such as the Vaults, which allow you to save up money regularly.

Do the challenge with your friend

Having a challenge with a friend will motivate you to stay on the right track. It’s more fun and you will be usually more accountable to follow through with your plan.

Make it your new year’s resolution

If you are someone who believes in new year’s resolutions, you can make your 52-Week Money Saving Challenge your resolution. In fact, nearly one-third of Americans make money-centric new year’s resolutions.

Add additional payments

Did you get some additional income or a tax refund? Instead of spending it right away, add the cash towards your money-saving challenge. Trust me, you will enjoy it more when it adds up to your final balance.

Do the challenge backward

A trick many people use when participating in the 52-Week Money Challenge is to do it backward, meaning you save up $52 the first week, $51 the second week, and so on. This method is particularly useful when applying my little hack with P2P lending.

Who is the 52-Week Money Saving Challenge for?

The 52-Week Money Saving Challenge isn’t only for people who want to save up money for their travels. It’s for anyone who wants to improve their financial situation in order to afford a bigger investment.

You don’t need to wait until new year’s. The sooner you start with your 52-Week Money Challenge the sooner you will reach your financial goals and the sooner you can start traveling.

Need help with your money mindset? Explore the best money affirmations that work instantly.